I recieved a lovely comment on the blog from Sacha

an it reminded me of everything I did wrong trading yesterday.

Cascade Failure

A cascading failure is a failure where connected parts in which the failure of a part can trigger the failure of successive parts. Cascading failures can happen anywhere and in any system ( airplanes, bridges ) and it is basically one things leads to another that leads to another usually bad thing.

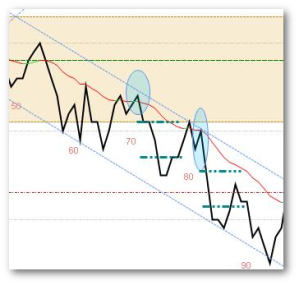

Cascade Failure Trading the TF Russell 2000

I was trading the TF, and my router was having problems so I started trading on the family computer. Not that that is a problem, it is the location. Instead of being in the ‘Batcave’, it is where everyone passes through.

This was my first mistake. Asking others to not disturb me in a public area of the house.

When I am scalping , I usually only scalp the open, so I concentrate on staying calm and watching the market.

I was fine until someone came in and started talking about an small issue that could wait. Then the conversation started about not bothering me, etc. It was all in terms of thoughtfulness and caring so there is nothing to be upset about, just that the act of calmly explaining to someone , talking about not distracting me is distracting me.

Right after that, I made my first trade. I had a brain fart because I was not concentrating and placed a limit order where there was not a trade. I had forgotten to set an ATM and the order filled without and profit target or loss order. So I am scrambling to place them on an unfamiliar computer and I was not as fast as I should have been. i also realized I should not have been in the trade. The market hit my initial stop and I was down 12 ticks.Not a lot, but really frustrating. I then ran an ether net line back to the batcave and proceeded to try to trade. I the next trade, I had a profit target of 5 ticks and the market moved my way and I moved my target to 20 ticks. Made 10 ticks and then gave it all back and scratched. Stupid revenge trading. I had no basis for that except for the fact that I had lost money and “I wanted to get it back”. Luckily it was only one trade before I regained my composure. The market does not owe you anything, it is not personal.

The market does not owe you anything

So now I was totally, pissed and I just had to step back, calm down, and get my mind back in the game. I calmed down and traded like I should have for the rest of the day. When the market started getting a bit too choppy and I stopped for the day.

Total for the day was 6 trades, +8 ticks on winners and -12 ticks on the one losing trade. It seems like a lot of trading, but two of the trades were for a combined -11 ticks, and I averaged ~2 ticks a trade for the others.

There were a couple of thing that I could have done.

(1) don’t be distracted

First mistake, I never should have left the Batcave. Trading is lonely, but when it is noisy, even less so.

(2) developing a jedi mindset

I needed to stay calm and trade. I won’t repeat it here but here is a good blog post.

How to Not Have a Cascade Failure

When something is going wrong, stop trading, close your positions and walk away until you have your “jedi” mindset back.

Also, thanks for reading , I think this is my longest blog post ever.

TRADING IS BORING

TRADING IS BORING